how do you calculate cash flow to creditors

Ad Factor Your AR Invoices Increase Cash Flow. When a company pays all its debt in cash form and not any other liquid asset it increases the cash flow to the.

18500 -15000 -30000 -26500.

. SOLVED You have been given the following information about the production of Usher Co and are asked to provide the plant manager with information for a Accounting. How do you calculate cash flow to creditors if you are not given long term debt. E Ending Long Term Debt.

Rated the 1 Accounting Solution. Add back all non-cash items. Net cash flow cash inflows cash outflows.

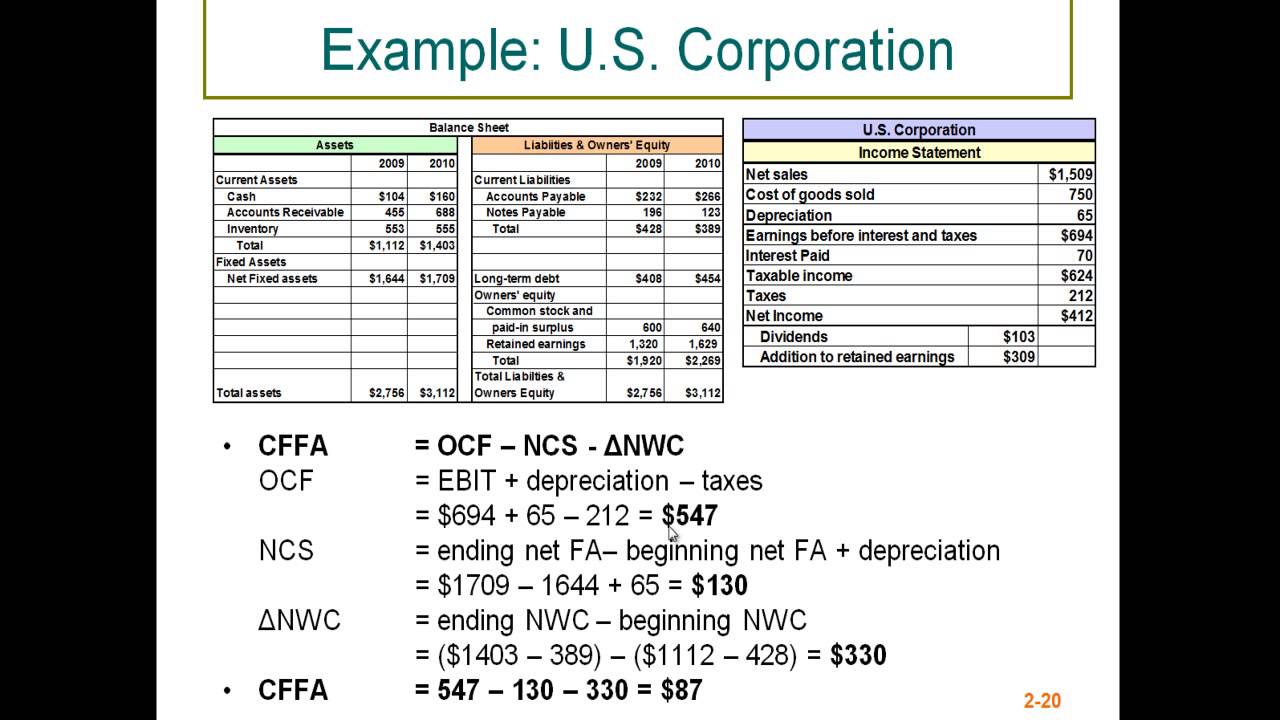

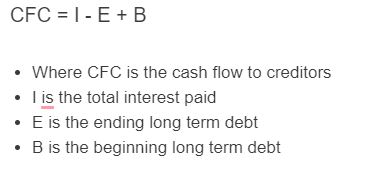

Start calculating operating cash flow by taking net income from the income statement. Where I Interest Paid E Ending Long Term Debt B Beginning Long Term Debt. The formula of cash flow to creditors interest paid - net new borrowing.

Net new borrowing asks for. The following formula is used to calculate the cash flow to creditors. Cash flow to creditors Interest paid Lon View the full answer Transcribed image text.

Choose From Top Providers Save on Cash Flow Factoring. The simple formula above can be built on to include many different items that. Get Quotes from Top Companies.

In this case depreciation and. The formula of cash flow to. B Beginning Long Term Debt.

Heres how to calculate the cash flow from assets. When Does Cash Flow To Creditors Increase. Cash Flow to Creditors I - E B.

Creditors interest paid net new borrowing. Cash flow from Assets - Cash flow to creditors Cash flow to stockholders. How do you calculate cash flow to creditors if you are not given long term debt.

If you wonder how to calculate net cash flow the formula is. Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is.

Net new borrowing asks for ending. Do you know how to calculate cash flow. Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to.

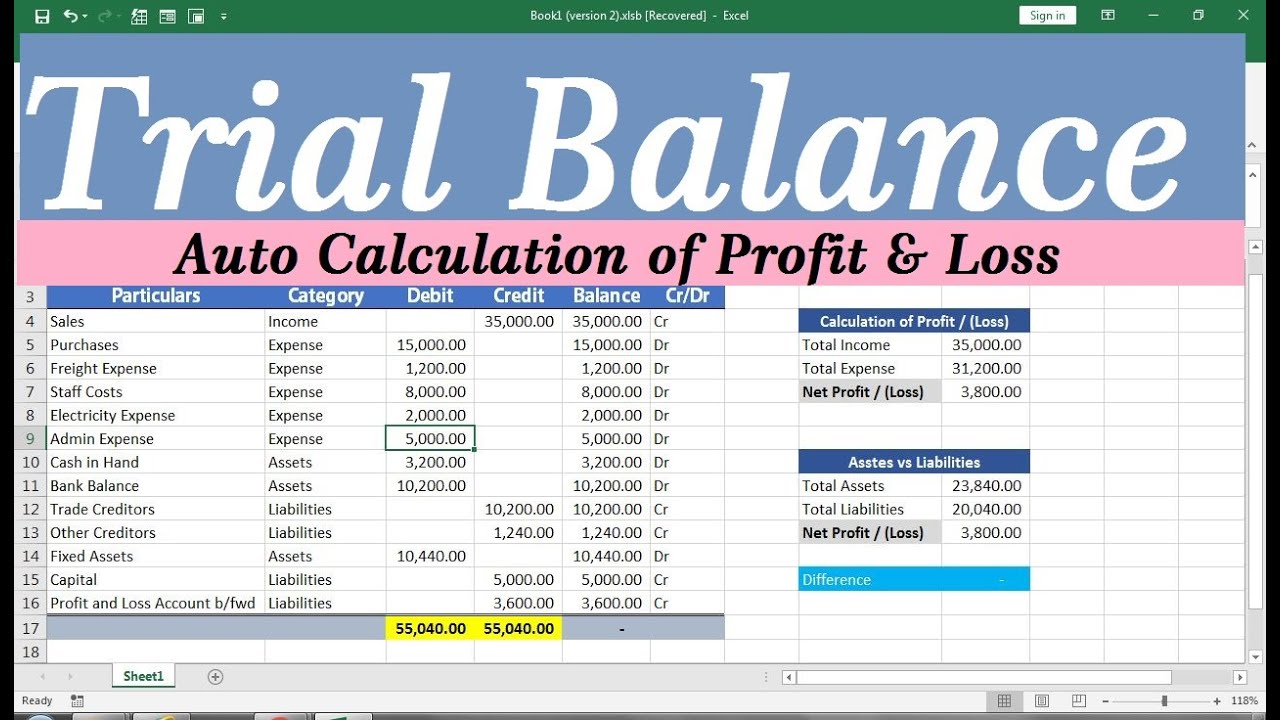

Since so many transactions involve non-cash items you have to alter how you calculate their effect on cash flow. Ad QuickBooks Financial Software. Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital.

Where I Interest Paid. There are two different methods that can be used to.

Financial Forecasting And Planning Model Excel For Business Financial Planner Tracker Business Planner Bookkeeping Budgeting

Branches Of Accounting Accounting Jobs Bookkeeping Business Accounting Education

Cash Flow To Creditors Calculator Calculator Academy

Debtors And Creditors Control Accounts Accounting Basics Financial Peace University Accounting

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Learn Accounting Accounting Basics

Cash Flow To Creditors Calculator Calculator Academy

The Trial Balance Trial Balance Accounting Basics Accounting

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Account Payable Vs Accrued Expense Top 6 Differences To Learn Accounts Payable Accounting Basics Accounting

Statement Of Cash Flows Direct Method Youtube

How To Make Profit And Loss Account And Balance Sheet In Excel Balance Sheet Trial Balance Balance

Training Financial Modeling Fundamentals Working Capital Debtors Modano

Modules Guide Creditors Financial Statement Impacts Modano

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano