irs child tax credit 2022

What are the child tax creditsIn 2021 the Child Tax Credit is available for children aged 6 to 17 with a maximum. Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year.

Our phone assistors dont have information beyond whats available on IRSgov.

. A child tax credit CTC is a tax credit for parents with dependent children given by various countries. In the meantime the expanded child tax credit and advance monthly payments system have expired. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27 2022.

Ad Schedule 8812 More Fillable Forms Register and Subscribe Now. The IRS Child Tax Credit Portal allows taxpayers to make their tax returns online. Find answers about advance payments of the 2021 Child Tax Credit.

The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents. Page Last Reviewed or Updated. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100.

The 2000 credit increases to 3600 for children under 6 at the end of 2021. WASHINGTON The Internal Revenue Service today updated its frequently asked questions FAQs FS-2022-17 PDF on the 2021 Child Tax Credit and Advance Child Tax Credit PaymentsThese updates are to help eligible families properly claim the credit when they prepare and file their 2021 tax return. Making the credit fully refundable.

The IRS child tax credit has been a part of the tax code since 1997. This provision allows you to deduct a certain amount of money from your taxable income if you have a qualifying child. Taxpayers should keep their address up to date with the Internal Revenue Service.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. However unless Congress acts those expanded 3000 and 3600 child tax credits will go back to. The 2000 credit increases to 3000 for children between 6 and 17.

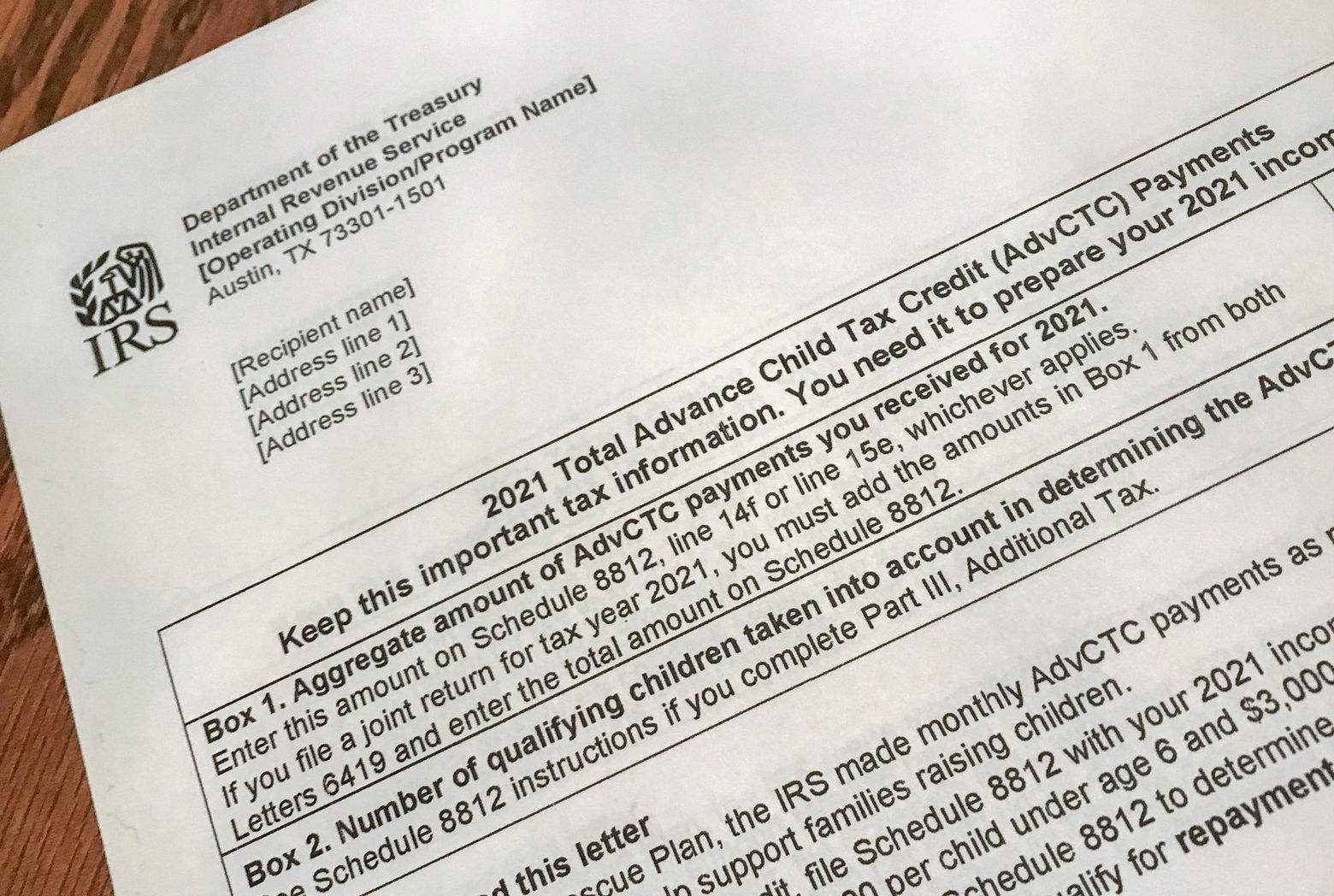

Self-Employment Tax Return Including the Additional Child Tax Credit for. Taxpayers can input all of the necessary information on the tax return and the software will automatically compute the tax liability. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim.

This will minimize delays in the receipt of IRS letters or refunds. Parents with one child can claim. These payments were part of the American Rescue Plan a 19 trillion dollar.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. The new advance Child Tax Credit is based on your previously filed tax return. Connecticut Child Tax Credit 2022-IRS Work at Home job httpslnkding8PkdR5U childtaxcredit2022 ctc taxrefund2022.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico 2021 01212022 Inst 1040-SS. 2021 Child Tax Credit and Advance Child Tax Credit Payments Frequently Asked Questions Internal Revenue Service.

02242022 Publ 972 SP Child Tax Credit Spanish Version 2022 02252022 Form 1040-SS. IRS Child Tax Credit Portal Login 2022 Update Bank. Making the credit fully refundable.

For 2021 only tax returns filed in April 2022 the Child Tax Credit for children under 17 changes in the following ways. The importance of taxes and family. Parents can still count on the remaining portion of their 2021 child tax credit this tax season.

Your guide to a better future. Instructions for Form 1040-SS US. How Much Does The Irs Give You Per Child.

Eligibility Rules for Claiming the 2021. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. So far the average refund in 2022 was a little over 200 more than last year.

2021 Child Tax Credit Basics. The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age. Those checks stopped in January because the.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

Frequently asked questions about Tax Year 2021Filing Season 2022 and the Child Tax Credit. IRS Child Tax Credit Portal Update Bank Information. 18-Jan-2022 EITC footer menu 1.

1 day agoAs of 20 May the IRS had sent out over 96 million tax refunds for 2021 fiscal declarations. Ad File a free federal return now to claim your child tax credit. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

No more checks coming. You are able to get a refund by March 1 2022 if you filed your return online you chose to receive your refund by direct deposit and there. Distributing families eligible credit through monthly checks for all of 2022.

IR-2022-53 March 8 2022. Tax Cuts and Jobs Act Tax Deductible Medical Expenses Tax Returns Health Insurance. Because you received part of your refund in the form of Advanced Child Tax payments in July August September October November and December your refund will most likely.

Now it is easier to spread the word about the Earned Income Tax Credit. Child Tax Credit 2021 vs 2022. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022.

Irs Changes Guidance On Child Tax Credits Accounting Today

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Summary Of Eitc Letters Notices H R Block

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Irs Child Tax Credit Payments Start July 15

Got 10 000 These 3 Growth Stocks Also Pay Dividends The Motley Fool In 2022 No Credit Check Loans Social Security Benefits Federal Income Tax

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Taxpayers Must Provide Ids Face Scans To Sign Into Their Irs Accounts The Washington Post

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

The Best Credit Cards For Building Credit Of 2021 Netflix Netflix Codes Disney Musical

Here S What Every Taxpayer Needs To Know This Season According To Experts In 2022 Home Home Office Child Tax Credit

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

Pin By De Harris On Tips Tax Refund How To Find Out Income Tax

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet